Best Electronics Insights

Your go-to source for the latest in electronics news and reviews.

Trade Secrets: Your Step-by-Step Blueprint for CS2 Reverse Trades

Unlock the secrets to CS2 reverse trades! Discover your ultimate step-by-step blueprint for trading success and maximize your profits today!

Understanding the Basics: What Are CS2 Reverse Trades?

CS2 reverse trades refer to a specific trading strategy used predominantly in financial markets, particularly in portfolios involving options and equities. Understanding the concept of reverse trades is vital as they allow traders to exit existing positions while simultaneously entering new ones. This approach can be particularly beneficial when market conditions are unfavorable or when traders wish to lock in profits or minimize losses. In essence, a reverse trade is executed to optimize the overall trading strategy by engaging in transactions that counter the original positions taken.

To grasp the mechanics of CS2 reverse trades, it is essential to comprehend the underlying principles of trading. For instance, when a trader holds a position that is no longer aligned with their market outlook, they may execute a reverse trade to mitigate risk and adjust their portfolio. This process generally involves buying back previously sold securities or selling those that were bought. By effectively using reverse trades, traders can enhance their adaptability to market fluctuations and improve their investment outcomes.

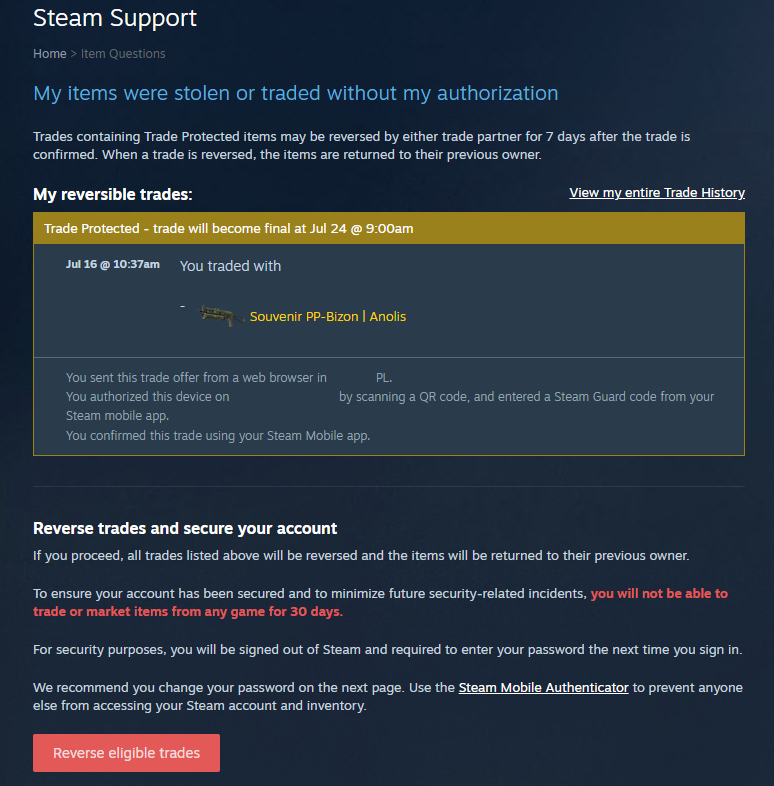

Counter-Strike is a highly popular team-based first-person shooter that has captivated gamers for years. It requires strategic thinking, teamwork, and precise aim to succeed. For players looking to learn about game mechanics, you can check out this guide on how to reverse trade cs2, which provides valuable insights and tips.

Mastering the Strategy: How to Execute Successful Reverse Trades in CS2

Mastering the strategy of executing successful reverse trades in CS2 requires an in-depth understanding of game mechanics and player psychology. A successful reverse trade involves anticipating your opponent's actions and countering them effectively. To start, you should analyze your opponents' tendencies in previous matches. This might include their preferred guns, common positions, and their reaction to pressure. By gathering this intel, you can devise a tactic that plays to your strengths while exploiting their weaknesses.

Once you have a strategy in place, communication with your team is crucial. Use clear and concise callouts to coordinate your movements and execute the reverse trade effectively. For instance, if you're planning to bait your opponent into a particular spot, ensure that your teammates understand their roles and timing. Remember that successful reverse trades often hinge on the element of surprise; therefore, maintaining unpredictability in your playstyle will keep your opponents on their toes. Continually refining your approach and learning from each trade will only enhance your execution and overall performance in CS2.

Common Pitfalls in CS2 Reverse Trading and How to Avoid Them

In the dynamic world of CS2 reverse trading, beginners often stumble into several common pitfalls that can hinder their performance and success. One major issue is failure to understand market trends. Traders tend to rely heavily on short-term fluctuations without analyzing the underlying trends that could influence their trades. This lack of foresight can result in significant losses. To avoid this, always start by conducting comprehensive market research and follow a well-defined trading plan that considers both short-term movements and long-term trends.

Another frequent mistake in CS2 reverse trading is the emotional decision-making process, where traders let their feelings drive their trades. Fear of losing can lead to premature exits, while overconfidence can prompt reckless entries. To counteract these emotional triggers, it’s essential to implement strict risk management strategies and stick to them. Setting limits on losses and gains not only helps in maintaining discipline but also reinforces a trading plan that is grounded in logic rather than emotion.